By Pamela Pierrepont Bardo

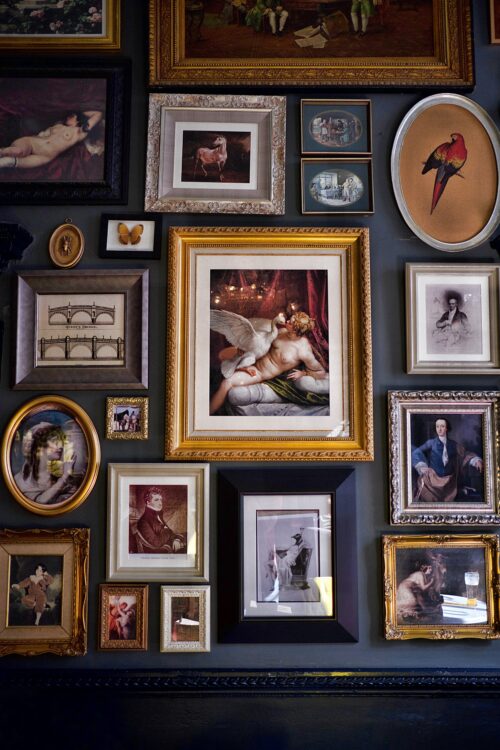

Estate planning is a critical consideration for individuals from all walks of life, and this holds particularly true for art collectors and collectors of other valuable items. Whether you’ve painstakingly curated a collection of priceless masterpieces or amassed a selection of cherished artworks, planning for the future of your collection is essential. Estate planning not only ensures that your artistic legacy lives on but also provides an opportunity to mitigate estate taxes, ensuring your beneficiaries are not burdened with unnecessary financial complexities. Agnes Ptasznik, an Estate Planning Attorney with the firm of Chuhak & Tecson, P.C.*, explains below the importance of estate planning and significance of each building block of a basic estate plan.

For art collectors, estate planning involves crafting a comprehensive strategy for the seamless transfer of your art collection to your chosen beneficiaries. This may include specifying how your artworks should be distributed among heirs, preserving the cultural and historical significance of your collection, and addressing any potential challenges associated with maintaining and managing your art. Appraisals by Certified Appraisers belonging to one of the national appraisal societies like American Society of Appraisers or Appraisers Association of America is vital. By doing so, you can safeguard your collection from potential disputes, maintain its integrity, and continue its legacy for generations to come.

At the heart of effective estate planning, especially for collectors of art and other valuable items, is the understanding of what a trust is. A trust is a legal entity that allows you to place assets, including your art collection, under the control of a trustee for the benefit of specific individuals or entities, known as beneficiaries. Trusts can be an invaluable tool for ensuring the organized and efficient distribution of your assets, including your art, while providing privacy and potentially reducing estate taxes.

When an estate plan includes a trust, a “pour over will” is an essential component of your estate planning strategy. This legal document is used to transfer any assets not already designated to a trust into that trust upon your passing. For art collectors, this means that any overlooked or newly acquired artworks will seamlessly become part of the trust, ensuring that your entire collection is managed and distributed according to your wishes. Additionally, for parents with minor children, guardianship provisions can be outlined in your pour-over will, allowing you to specificy who will care for and make financial decisions for your children, if necessary.

Furthermore, estate planning also encompasses the appointment of powers of attorney. These legal documents allow you to designate someone to make critical healthcare and financial decisions on your behalf if you become unable to do so. This ensures that your preferences are honored, even in challenging circumstances.

Estate planning for art collectors is not only about preserving your legacy but also about ensuring that the transfer of your collection is as tax-efficient as possible. Art collections often hold significant value, and without proper planning, they can lead to substantial estate taxes. Estate tax planning techniques, such as establishing trusts or taking advantage of deductions and credits, can help minimize the financial impact on your heirs while allowing you to preserve your artistic heritage. It’s an investment in securing your family’s financial future and the continued appreciation of your art. To embark on this journey, it’s advisable to get a certified tax and estate planning appraisal and to consult with a qualified estate planning professional who understands the nuances of art collections and can guide you through the intricate process of preserving your artistic heritage while minimizing estate tax liabilities. With careful planning, you can pass on your cherished art collection to the next generation with confidence and peace of mind.

*This communication from Agnes Ptasznik and Chuhak & Tecson, P.C. is intended only to provide information regarding developments in the law and information of general interest. It is not intended to constitute advice regarding legal problems and should not be relied upon as such.

Agnes Ptasznik, J.D., Chuhak & Tecson, P.C.

Pamela Pierrepont Bardo, ASA, AAA